Eligibility

In order to help you determine if you are eligible, simply work down the checklist below. A parent or guardian can submit the application on your behalf. Completion of all boxes does not guarantee that you will be eligible but it will give you an indication of your chances of success. Applicants must be under the age of 25 and fall under one of the following categories: Category 1: The person in respect of whom an application is made (“the applicant”) must have been born in the Parish of Lumphanan or his/her parents were resident in Lumphanan at the time of birth. Category 2: The applicant has lived in the Parish of Lumphanan for five years prior to the date of the application, and continues to live there. Category 3: The applicant was born in either the Parish of Torphins or the Parish of Kincardine O' Neil, or the applicant's parents were resident within either of these Parishes at the time of the applicant's birth or the applicant has lived within either of those Parishes for five years prior to making the application, and continues to live there. Google Map showing geographical boundary of eligibility Blue is Lumphanan Parish, Red is Torphins & Kincardine o’ Neil Parish Download Map (High Res jpg file) Download Google Earth Boundary Files (kmz) Lumphanan - Torphins & Kincardine o’ Neil

© 2022 Davie Trust

Any successful applicant will require to produce identification documentation along with paperwork from the College or

University confirming their place to the Trustees before payment can be made.

The Trustees have discretion to determine the percentage of the Trust’s Standard Grant to be awarded to any applicant in

light of any special circumstances which they consider should be taken into account. However, the undernoted table may

assist you in estimating the level of award that you may receive.

Capital assets may also be taken into account when the Trustees are considering the level of payment which can be made.

Families receiving income from self employment must provide the Trustees with a copy of their business audited accounts

for the latest 3 years. These will be used to calculate an average income from which the Trustees will base their decision.

Any delay in producing these accounts could result in delays in the payment of any grant awarded.

Lumphanan Parish

Torphins and

Kincardine o’ Neil Parish

Eligibility

In order to help you determine if you are eligible, simply work down the checklist below. A parent or guardian can submit the application on your behalf. Completion of all boxes does not guarantee that you will be eligible but it will give you an indication of your chances of success. Applicants must be under the age of 25 and fall under one of the following categories: Category 1: The person in respect of whom an application is made (“the applicant”) must have been born in the Parish of Lumphanan or his/her parents were resident in Lumphanan at the time of birth. Category 2: The applicant has lived in the Parish of Lumphanan for five years prior to the date of the application, and continues to live there. Category 3: The applicant was born in either the Parish of Torphins or the Parish of Kincardine O' Neil, or the applicant's parents were resident within either of these Parishes at the time of the applicant's birth or the applicant has lived within either of those Parishes for five years prior to making the application, and continues to live there. Google Map showing geographical boundary of eligibility Blue is Lumphanan Parish, Red is Torphins & Kincardine o’ Neil Parish Download Map (High Res jpg file) Download Google Earth Boundary Files (kmz) Lumphanan Torphins & Kincardine o’ Neil

Scottish Charity SC024169

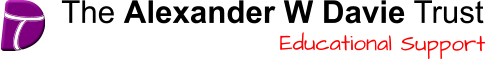

Gross Annual

Household Income

2 Parents

plus 1 dependent

child

2 Parents

plus 2 dependent

children

2 Parents

plus 3 dependent

children

Two Parents

plus maximum of 4

dependent children

Gross Annual

Household Income

1 Parent

plus 1 dependent

child

1 Parent

plus 2 dependent

children

1 Parent

plus 3 dependent

children

1 Parent

plus maximum of 4

dependent children

Two Parent Families

One Parent Families

Up to £40,000

Up to 100%

Up to 100%

Up to 100%

Up to 100%

Up to £44,000

Up to 75%

Up to 100%

Up to 100%

Up to 100%

Up to £48,000

Up to 50%

Up to 75%

Up to 100%

Up to 100%

Up to £52,000

Up to 25%

Up to 50%

Up to 75%

Up to 100%

Up to £58,000

0%

Up to 25%

Up to 50%

Up to 75%

Up to £60,000

0%

0%

Up to 25%

Up to 50%

Up to £64,000

0%

0%

0%

Up to 25%

Over £64,001

0%

0%

0%

0%

Up to £35,000

Up to 100%

Up to 100%

Up to 100%

Up to 100%

Up to £39000

Up to 75%

Up to 100%

Up to 100%

Up to 100%

Up to £43,000

Up to 50%

Up to 75%

Up to 100%

Up to 100%

Up to £47,000

Up to 25%

Up to 50%

Up to 75%

Up to 100%

Up to £51,000

0%

Up to 25%

Up to 50%

Up to 75%

Up to £55,000

0%

0%

Up to 25%

Up to 50%

Up to £59,000

0%

0%

0%

Up to 25%

Over £59,001

0%

0%

0%

0%

The Standard Grant

If studying whilst living at home up to - £3,900

If staying away from home up to - £7,800

The % can however be amended at the discretion of the Trustees, if they feel that there are special circumstances.

Any successful applicant will require to produce identification documentation

along with paperwork from the College or University confirming their place

to the Trustees before payment can be made.

The Trustees have discretion to determine the percentage of the Trust’s Standard

Grant to be awarded to any applicant in light of any special circumstances which

they consider should be taken into account. However, the undernoted table may

assist you in estimating the level of award that you may receive.

Capital assets may also be taken into account when the Trustees are considering

the level of payment which can be made. Families receiving income from self

employment must provide the Trustees with a copy of their business audited

accounts for the latest 3 years. These will be used to calculate an average

income from which the Trustees will base their decision.

Any delay in producing these accounts could result in delays in the payment

of any grant awarded.

Capital assets may also be taken into account when the Trustees are considering the level of

payments which can be made.

Families receiving income from self employment must provide the Trustees with a copy of their

business audited accounts for the latest 3 years. These will be used to calculate an average income

from which the Trustees will base their decision. Any delay in producing these accounts could result

in delays in the payment of any grant awarded.